On November 9, 2016, a 40-minute speech by PM Narendra Modi wiped off more than 85% of India’s monetary base. What could once guarantee you a lavish meal at the choicest 5-star hotel overnight became as good as toilet paper. The demonetization of Rs.500 and Rs.1,000 notes took India by storm, and would probably be the most historically remembered event for years to come.

Tryst with Destiny

This latest incident is no less significant than erstwhile PM Nehru’s speech on the eve of India’s Independence. “At the stroke of the midnight hour, when the world sleeps, India will awake to life and freedom,” the Tryst with Destiny speech claimed. The midnight of November 8, 2016 saw India waking up to a master stroke against black money and fake currency.

Nehru’s speech went on to say, “A moment comes, which comes but rarely in history, when we step out from the old to new, when an age ends, and when the soul of a nation, long suppressed, finds utterance.” PM Modi’s initiative also promises to take India to a new age. What’s more commendable (and heartening, if I may add) is the support that the common man has exhibited to this initiative, despite the inconveniences and hardships. As a nation, we do stand together in the face of difficulties, and are willing to take on inconveniences with a smile in anticipation of a better India in the longer term.

The Economy Comes to a Grinding Halt

Thanks to the penetration of smart devices in the country, it didn’t take long for people to halt everything they were doing and tune into the news. And, as we witness so often, change breeds panic. The immediate impact was of snaking queues at every bank and ATM. But that’s just the beginning.

Overnight, the circulation of money came to a standstill. India has a population of 1.3 billion and the poorest 50% spend Rs.67 per person per day. This translates to almost Rs.90 billion, or Rs.9,000 crores, that has gone out of daily circulation!

Although India has made tremendous progress in technology adoption over the past decade, it is still a cash economy, with more than 90% of all transactions being conducted in cash. Imagine the impact of the freezing of money circulation on any business, especially the smaller merchants and retailers!

People began conserving the money that was still legal tender. Demand plummeted even for consumer goods, apart from the expected declines for real estate, gold, automobiles and luxury goods.

The Impact Maybe More Long-Lasting Than Expected

Although the new Rs.500 and Rs.2,000 notes are already available, there’s an extremely low limit set for withdrawal. Even when these limits are eased, it will take quite a while for the massive engine to begin chugging again at the same momentum. Money needs to be in wide circulation for businesses to regain their standing. In fact, the curtailment of reserve money will continue to impact the economy for a few months to come.

All’s Well That Ends Well

“Surgical strike on corruption”, “master stroke,” “big bang reform”… call it by whatever phrase you’d like, the truth is that the impact of the move is still to be fathomed by Indian businesses and economists.

India has been quick to adopt smartphones and smart tablets, be it kids, the working population or seniors. By the end of 2015, India’s base had grown to 220 million users, surpassing the US to become the second-largest market in the world for such devices, according to statistics published leading industry analysis firm Counterpoint.

Oddly, the country has so far resisted going digital, at least as far as making payments is concerned. To say that demonetization would boost technology adoption would be a huge understatement. This is already happening, with people already turning to online wallets for buying consumer goods, grocery shops, medicines and fuel. In fact, PayTM reported a 200% increase in app downloads in just two weeks, while

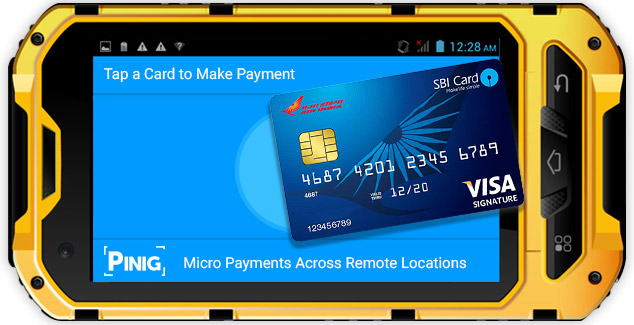

India would need to let go of its love for cash transactions and move to net banking or plastic money. An article by market research firm Technavio provides interesting forecasts for the growth of India’s mobile wallet market, while adding that many merchants and retailers would switch to mobile as a point of sale (PoS) to narrow the digital divide and give a fillip to financial inclusion.